02. BUSINESS CONTEXT

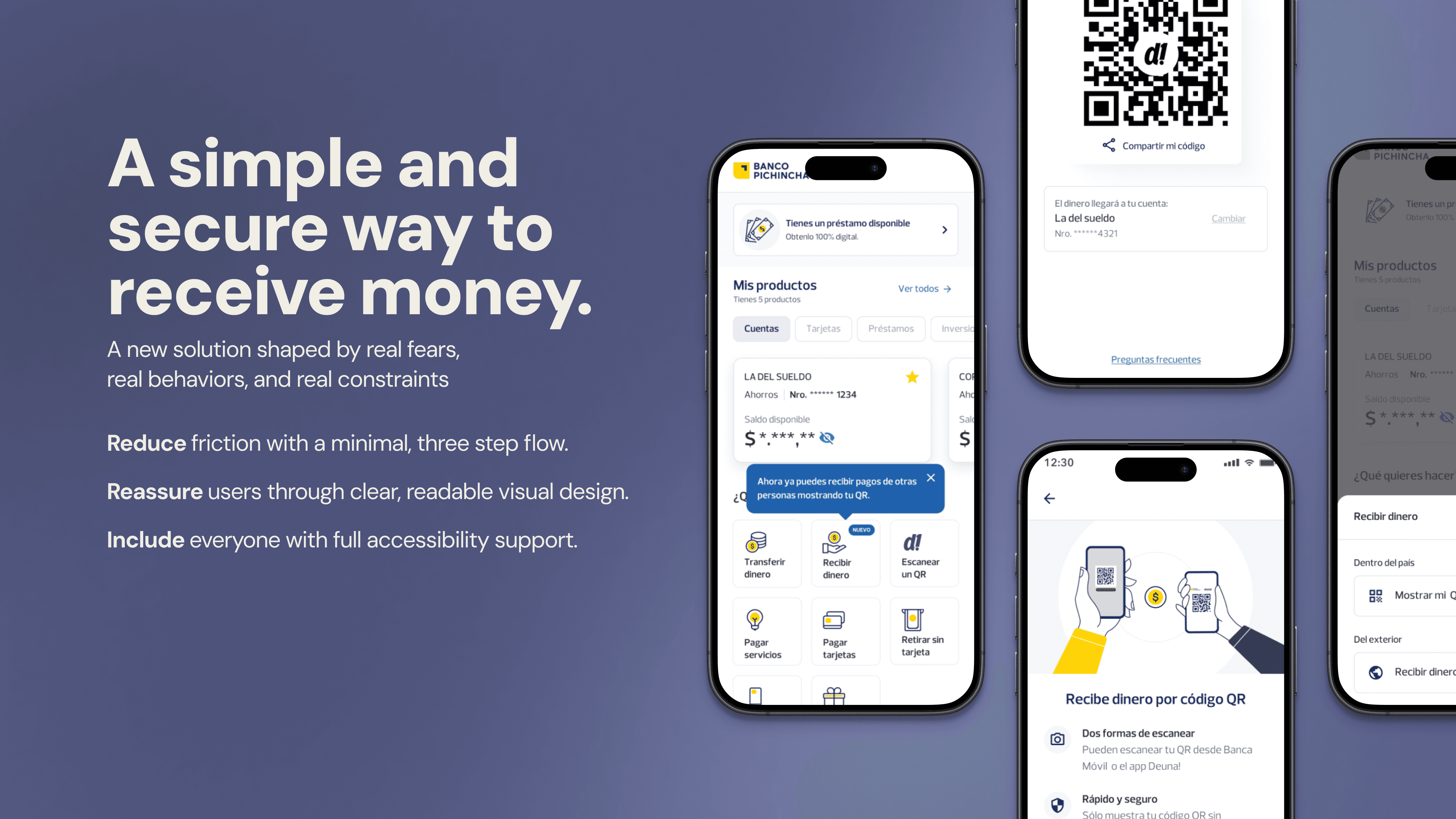

We want a new way to receive money

Leadership expected QR transfers to attract younger users and speed up peer-to-peer payments. However, this initiative didn’t originate from user needs. Before designing, we validated whether customers actually understood or wanted this new channel, and uncovered concerns the business hadn’t anticipated.

03. USER INSIGHTS

Security fears

In Ecuador, safety concerns heavily influence digital behavior. Many users believed criminals could scan their phone in public and instantly take their money. This perception made trust-building essential.

Low digital literacy

Older and non-digital users didn’t understand how QR codes worked or how they “moved money.” Without simple language and predictable flows, adoption would be low.

Fast and modern → Simple, safe, and reliable

04. CONSTRAINTS

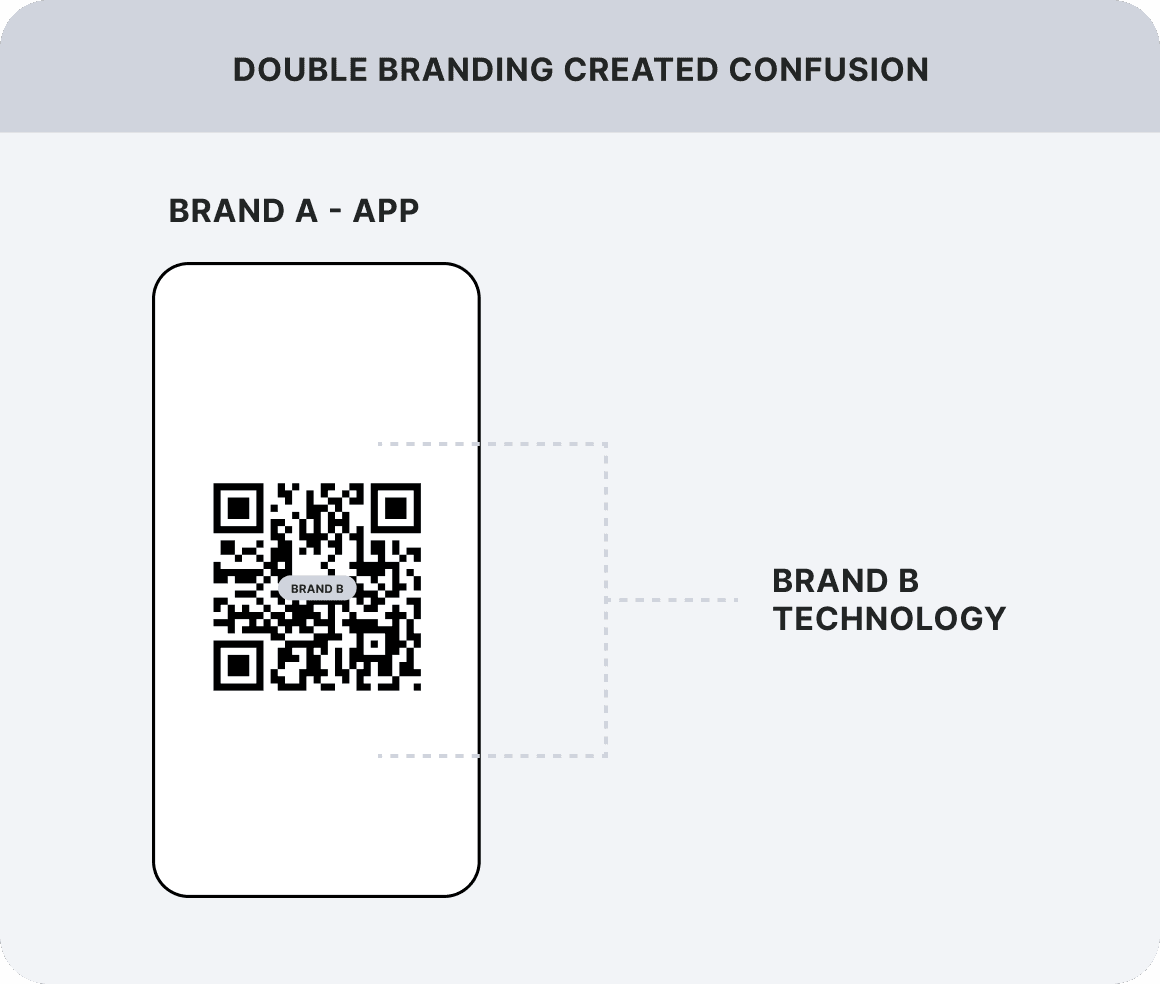

Sibling-company branding

The QR engine came from a sister company, whose logo appeared inside the generated QR code. Users found this confusing and suspicious “Why is another company inside my bank app?”

Backend dependency

We relied on the sibling company’s engineers to release APIs and logic. This slowed iteration and required close alignment.

Internal design pressure

The experience team pushed for decorative, graphic-heavy QR designs, even though these reduced scannability and increased cognitive load.

Information architecture restrictions

We weren’t allowed to modify the Transfer Hub. The feature needed a new entry point that didn’t disrupt existing navigation.

05. KEY DESIGN DECISIONS

1

Entry point: Receive Money bottom sheet

Since the main navigation could not be updated, we added a new entry on the home screen. A clear Receive Money button opened a simple bottom sheet. This solution was later adopted for other features, showing its long term value.

2

Minimal three step flow

To keep the experience fast, the final flow had only three steps. Receive Money, Show QR Code and the QR screen itself. No onboarding and no unnecessary screens.

3

Simple high contrast QR code

Users trusted a plain black and white QR more than decorative alternatives. Simple visuals reduced cognitive load and improved scannability. The final version matched my original proposal.

4

Clarifying the double brand

To reduce confusion caused by the sibling company logo inside the QR, we added contextual UI explaining the shared payments engine. Consistent spacing and color made the relationship feel intentional.

06. ACCESSIBILITY

Transactions for everyone

Designing a money transfer feature meant making it truly usable for everyone. Accessibility was essential in this project because money transfers are a flagship feature of the app. Every customer, including older adults and users with visual impairments, needed to complete this task with confidence.

To support this, I created a full set of accessibility labels for the engineering team to integrate into the code. This ensured compatibility with screen readers and improved clarity during interactions.

The labels were organized into four categories:

Contextual labels: Provide users with an overview of the screen’s purpose and what they are about to do.

Event labels: Give feedback on user interactions with interactive elements, such as buttons, selectors or input fields.

Descriptive labels: Read out important screen elements like headings, descriptions or available actions.

Omission labels: ell the screen reader to skip elements that do not add value, such as decorative images, to reduce confusion.

These decisions were important because a confusing or partially accessible money transfer flow can quickly become a barrier. Ensuring clarity for all users, regardless of familiarity with technology or visual ability, was a core priority.

07. LEARNINGS

I learned to trust my design criteria when it is supported by evidence. Internal pressure for visual complexity does not always align with user needs. I also learned how to justify decisions clearly, how to balance multiple brands without confusing users and how to work with technical teams under real constraints.